Over the past decade, Fintech has been revolutionizing lending. The drastic improvements in seamless, ubiquitous, and inclusive lending have allowed more people and businesses easy access to loans, credit cards, and commercial facilities.

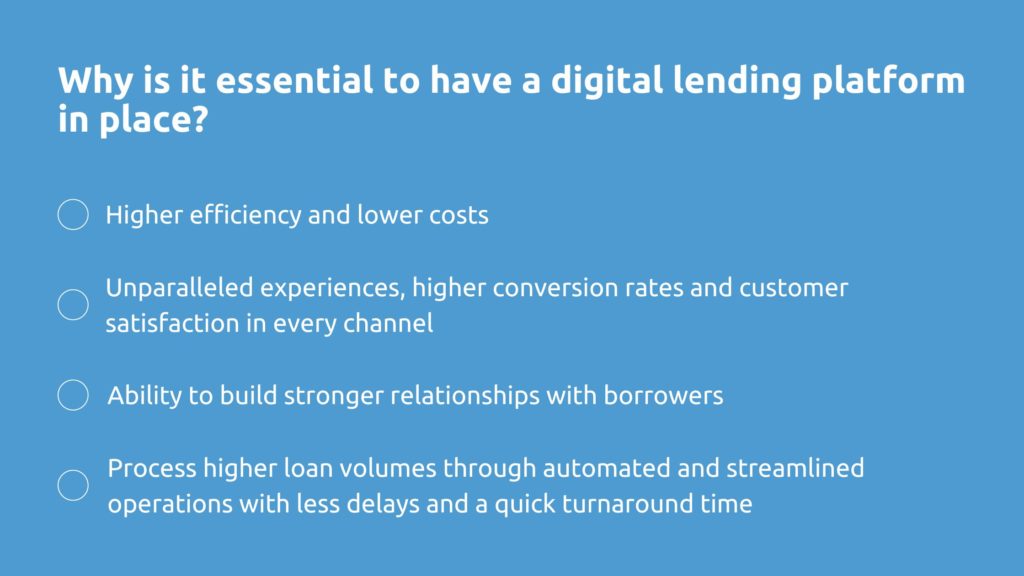

The COVID-19 pandemic was a major game-changer in that landscape. Lenders must adapt to customer expectations and leverage new technologies, and banks have to switch to digital loans instead of in-person services to reach their customers. Through digital lending, banks are able to increase financial inclusion in diverse markets and make lending more accessible to borrowers outside the banks’ geographical location.

Digital lending platforms help banks build long-term relationships with borrowers by streamlining the loan application process and increasing borrower retention and satisfaction.

Because of the immediate market need, more digital platforms are emerging in the lending ecosystem, making platform selection more difficult. Choosing a dependable digital lending platform is the first step toward optimizing the loan process and providing a seamless customer experience.

Bluering created this guide to help lenders select the best digital lending platform in providing the ultimate lending experience to borrowers and users, optimize the lending process, leverage the latest technology, and make the loan process more efficient, streamlined, transparent, and secure. So, what five factors should lenders consider when selecting a digital lending platform?

- Intuitive user experience

Because more and more users expect transactions to go smoothly, the user experience has emerged as one of the most influential factor to consider when selecting a digital lending partner. So, what makes a digital lending platform user-friendly?

Of course, an interface that looks nice is a plus, but that alone is not enough. Consider how long the application process takes or how simple it is to complete the application on the chosen digital lending platform.

Your platform should be simple, practical, and up-to-date to attract borrowers and provide an intuitive user experience allowing your credit experts to complete tasks quickly and easily.

- Latest technology

Digital lending platform providers must avoid obsolete technology. Old isn’t gold here. To give you a competitive advantage in the loan market, the digital lending platform provider should be your innovation partner, quickly incorporating technological trends into the platform.

Ensure that the selected provider is an expert in the newest software technologies and can offer different adoption and integration options and extensive platform analytics through advanced dashboards. The insights can help improve your loan decisions and portfolio efficiency.

The selected digital lending platform should integrate easily with internal and external systems and support pre-built integrations and APIs for customized data flows. These integrations allow you to exchange information with your core banking system, credit bureaus, KYC providers, pricing engines, and third parties.

Consider SaaS platforms, as they are easier to implement, use, and update. SaaS systems can be set up faster, work on a subscription model, and are frequently updated, making them versatile, scalable, and cost-effective.

- Comprehensive and flexible

The digital lending platform should be flexible enough to match your lending processes, market, client, and lending history, without requiring significant changes.

Consider whether the digital lending platform is adaptable to an individual level, modifiable (without compromising efficiency), configurable and customizable. A white-label solution allows you to integrate your bank’s look and feel into the platform, thus improving your lending experience.

The selected platform should support all products in your credit portfolio and all lending processes from origination to underwriting and execution. Your digital lending platform must handle everything, from credit requests to credit disbursements in the borrower’s account.

- The overall time of implementation

After you’ve decided on a digital lending platform, consider how long it will take to implement and integrate it into your current structure. Even though speed shouldn’t be the only thing you think about when choosing a platform, it can significantly affect your business opportunities.

Your digital lending platform provider should also demonstrate how quickly they can support your requests for future changes. Launching your digital lending platform quickly will help you stay ahead of your competition and get your business up and running.

Ask if there are any risks with the implementation that you need to know. You may need a dedicated point of contact on the provider’s side to support you with any bugs or problems, so make sure that the provider will assign a specialized team of experts for you.

- Industry experience

While user experience, superior technology, a comprehensive platform, and quick implementation and support are all crucial features in a digital lending platform, they are not always sufficient. Your platform provider must be a highly experienced company well-versed in banking and digital lending.

The ideal provider should already have a diverse portfolio and a proven track record of expertise in digital lending platform implementation and support, knowledge of the sector’s rules and compliance regulations, and the ability to provide solutions quickly.

Conclusion

Your ideal fintech lending partner should understand the credit business, be innovative and capable of bringing about future improvements, be knowledgeable about current technology, and allow for simple configuration and execution. Choose a comprehensive and user-friendly digital lending platform that balances automation and control to improve your bank’s efficiency.

About Bluering

Since 2007, Bluering has helped banks, microfinance institutions, and neobanks automate and streamline their lending procedures through comprehensive, no-code, and white-label digital lending solutions. With a quick implementation in less than 4 months, lenders benefit from rapid loan processing and an excellent lending experience. Are you curious about Bluering’s solutions? Contact our credit experts here