Bluering Microfinance covers end-to-end functionalities in one single platform.

Originate, underwrite, manage, disburse, and analyze your micro-loans.

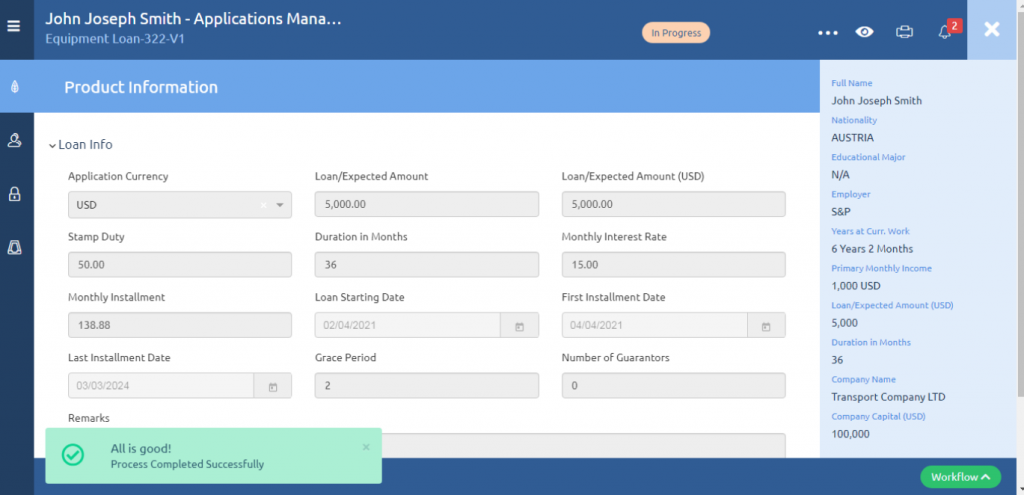

Accelerate your loan decision process and reduce non-performing loans through seamless automated workflows. With Bluering Microfinance, you can offer credit decisions in less than 24 hours and increase your customer satisfaction radically.

Go digital with Bluering Microfinance in less than 4 months.

Accelerate your loan decision process and reduce non-performing loans through seamless automated workflows. With Bluering Microfinance, you can offer credit decisions in less than 24 hours and increase your customer satisfaction radically.

Go digital with Bluering Microfinance in less than 4 months.

- Create products on the go. Set your own product rules, terms, and conditions in a couple of clicks

- Facilitate the transformation of your current operations

- Optimize your lending process by creating digital and automated processes, workflows, and

- Increase your lending capacity and issue more profitable loans

- Embrace technology to increase your market share

With Bluering Microfinance, you can originate and process various micro-loans

- Payday loans

- Bridge loans

- Salary advance loans

- Point of sales loans

- Small business loans

- Microloans